fulton county ga sales tax rate 2019

This rate includes any state county city and local sales taxes. This coupled with the base rate of Georgia sales tax means the effective rate is 89.

City Of South Fulton Ga Archives

The current total local sales tax rate in Floyd County GA is 7000.

. The Fulton County sales tax rate is 3. Surplus Real Estate for Sale. Click any locality for a full breakdown of local property taxes or visit our Georgia sales tax calculator to lookup local rates by zip code.

Average Sales Tax With Local. Rate Changes Effective July 1 2020 - UPDATED 12Jun2020 5752 KB Rate Changes Effective July 1 2020 5842 KB Rate Changes Effective April 1 2020 5395 KB Rate Changes Effective January 1 2020 5215 KB Rate Changes Effective October 1 2019 5374 KB Rate Changes Effective July 1 2019 558 KB. Sales Use Tax.

Rates include state county and city taxes. Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov. The Georgia state sales tax rate is currently 4.

Sales Use Tax Import Return. 2022 List of Georgia Local Sales Tax Rates. To review the rules in.

Sales Tax Calculator Sales Tax Table. Rates Due Dates. The 2018 United States Supreme Court decision in South Dakota v.

There is no applicable city tax. The Fulton County sales tax rate is. Georgia GA Sales Tax Rates by City.

The 1 MOST does not apply to sales of motor vehicles. 445 802 Views. Georgia has a 4 sales tax and Fulton County collects an additional 26 so the minimum sales tax rate in Fulton County is 66 not including any city or special district taxes.

Sales Use Taxes Fees Excise Taxes SAVE - Citizenship Verification. The Fulton County Sales Tax is collected by the merchant on all qualifying sales made within. The Fulton County Board of Commissioners does hereby announce that the 2021 General Fund millage rate will be set at a meeting to be held at the Fulton County Assembly Hall located at 141 Pryor Street Atlanta GA 30303 on August 18 2021 at 10 am.

Has impacted many state nexus laws and sales tax collection requirements. The 85 sales tax rate in Fulton consists of 6 California state sales tax 025 Sonoma County sales tax and 225 Special tax. Effective January 1 2019 through March 31 2019 28935 KB General Rate Chart.

If your business is based in Atlanta or you sell to customers in Atlanta then the sales tax rate is 49. The sales tax jurisdiction name is Sonoma County Tourism Business Improvement Area which may refer to a local government division. The latest sales tax rate for Atlanta GA.

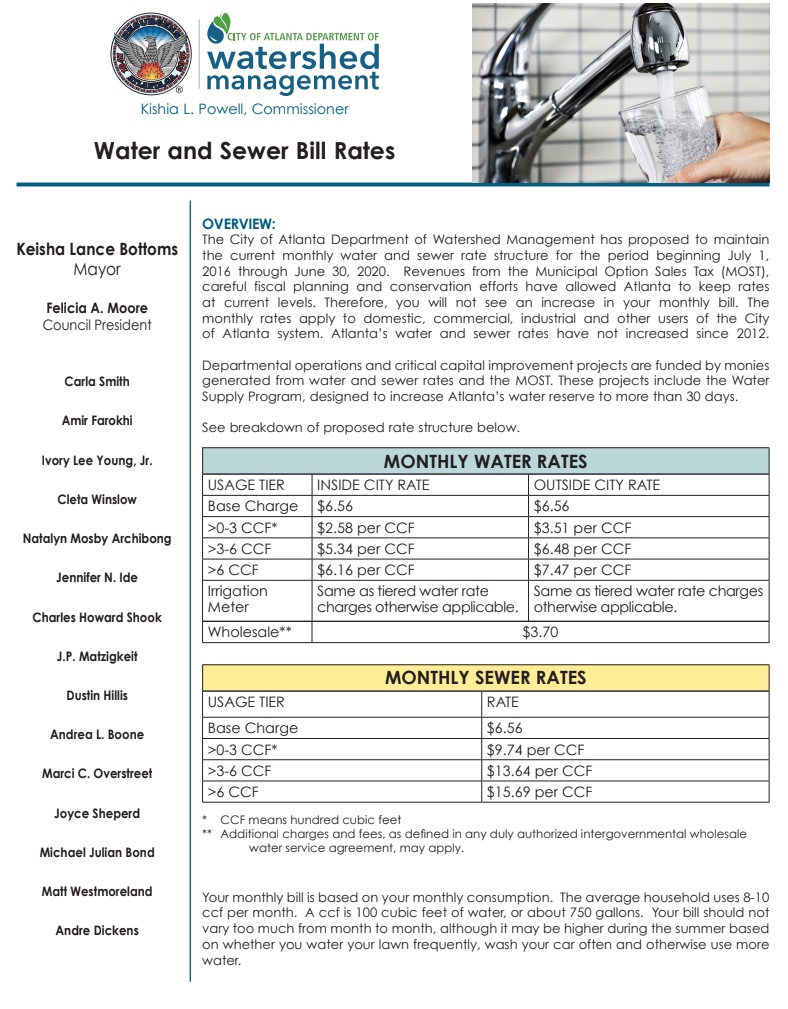

This table shows the total sales tax rates for all cities and towns in Fulton County. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. Valdosta GA Sales Tax Rate.

Gwinnett County collects a 2 local sales tax the maximum local. And pursuant to the requirements of OCGA. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Filing and Remittance Requirements This is a link to Rule 560-12-1-22 on the Georgia Secretary of States website. The state sales tax rate in Georgia is 4000.

26 Votes The minimum combined 2020 sales tax rate for Fulton County Georgia is 89. The Georgia state sales tax rate is currently. In Clayton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate.

Lowest sales tax 6 Highest sales tax 9 Georgia Sales Tax. The Board of Commissioners and County Manager have categorized County efforts into six strategic areas. Personal finance personal taxes.

2020 rates included for use while preparing your income tax deduction. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. FULTON COUNTY GEORGIA July 2019 FINANCIAL RESULTS Unaudited Cash Basis.

Local state and federal government websites often end in gov. The 85 sales tax rate in Atlanta consists of 4 Georgia state sales tax 26 Fulton County sales tax 15 Atlanta tax and 04 Special taxThe sales tax jurisdiction name is Atlanta Tsplost Tl which may refer to a local government divisionYou can print a 85 sales tax table hereFor tax rates in other cities see Georgia sales taxes by city and county. The Gwinnett County Sales Tax is collected by the merchant on all qualifying sales made within Gwinnett County.

2022 Georgia Sales Tax By County. This is the total of state and county sales tax rates. You can print a 85 sales tax table here.

There are a total of 476 local tax jurisdictions across the state collecting an. Helpful Links Cities of Fulton County. Tips for Completing the Sales and Use Tax Return on GTC.

The December 2020 total local sales tax rate was also 7000. With local taxes the total sales tax rate is between 4000 and 8900. Georgia has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4.

The Gwinnett County Georgia sales tax is 600 consisting of 400 Georgia state sales tax and 200 Gwinnett County local sales taxesThe local sales tax consists of a 200 county sales tax. The total 775 Fulton County sales tax rate is only applicable to businesses and sellers that are not in the Greater Atlanta area. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate.

2020 rates included for use while preparing your income tax deduction. 48-5-32 does hereby publish the following.

City Of South Fulton Ga Archives

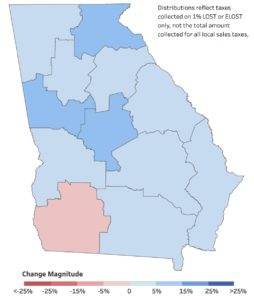

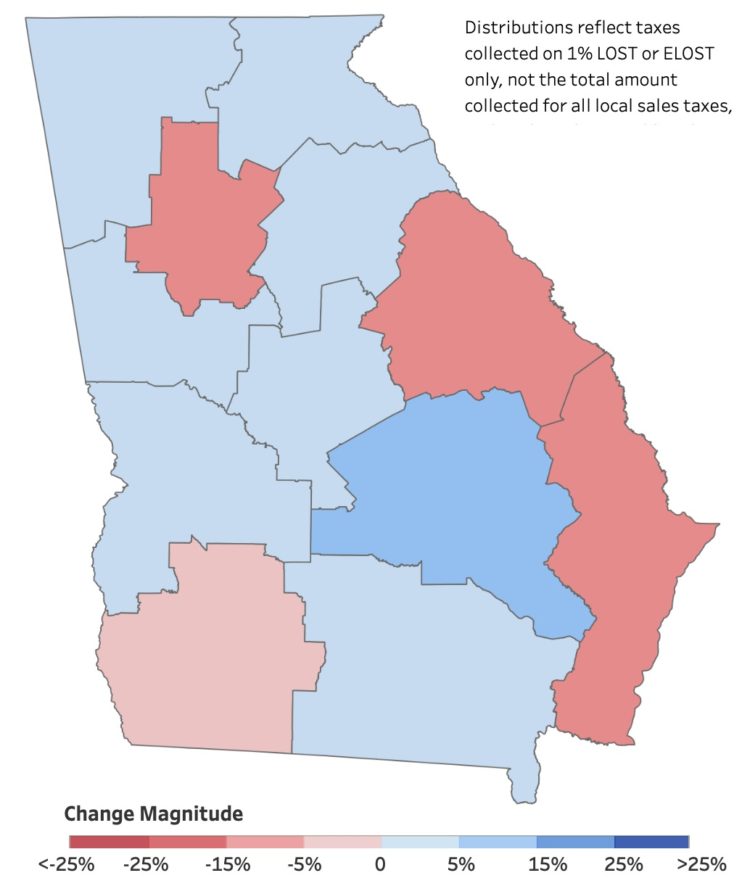

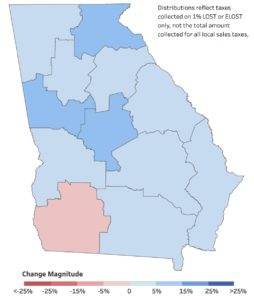

Sales Tax Collections Plummet At Least 15 In Metro Atlanta In June New Gsu Research Tool Saportareport

Sales Taxes In The United States Wikiwand

City Of South Fulton Ga Archives

Alpharetta Roswell Herald March 7 2019 By Appen Media Group Issuu

Sales Taxes In The United States Wikiwand

Is There Discrimination In Property Taxation Evidence From Atlanta Georgia 2010 2016 Sciencedirect

Atlanta Real Estate Market Stats Real Estate Marketing Atlanta Real Estate Marketing

Sales Tax Collections Plummet At Least 15 In Metro Atlanta In June New Gsu Research Tool Saportareport

Atlanta Georgia S Sales Tax Rate Is 8 5

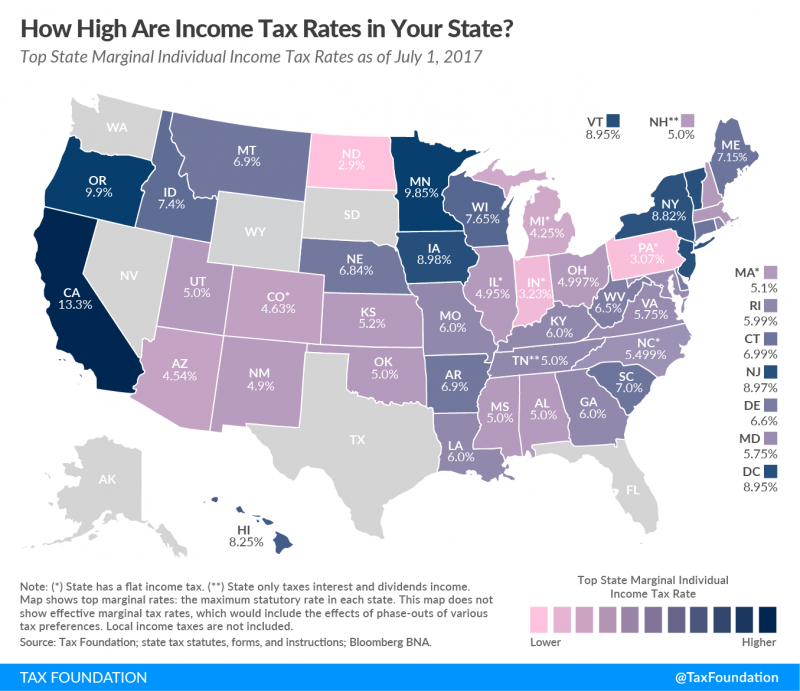

Federal Tax Reform Opens Opportunities For Georgia And For Rural Georgia Georgia Public Policy Foundation

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Is There Discrimination In Property Taxation Evidence From Atlanta Georgia 2010 2016 Sciencedirect

New York Sales Tax Guide For Businesses

Is There Discrimination In Property Taxation Evidence From Atlanta Georgia 2010 2016 Sciencedirect